moldvino.ru

Learn

Is Form 1065 The Same As 1040

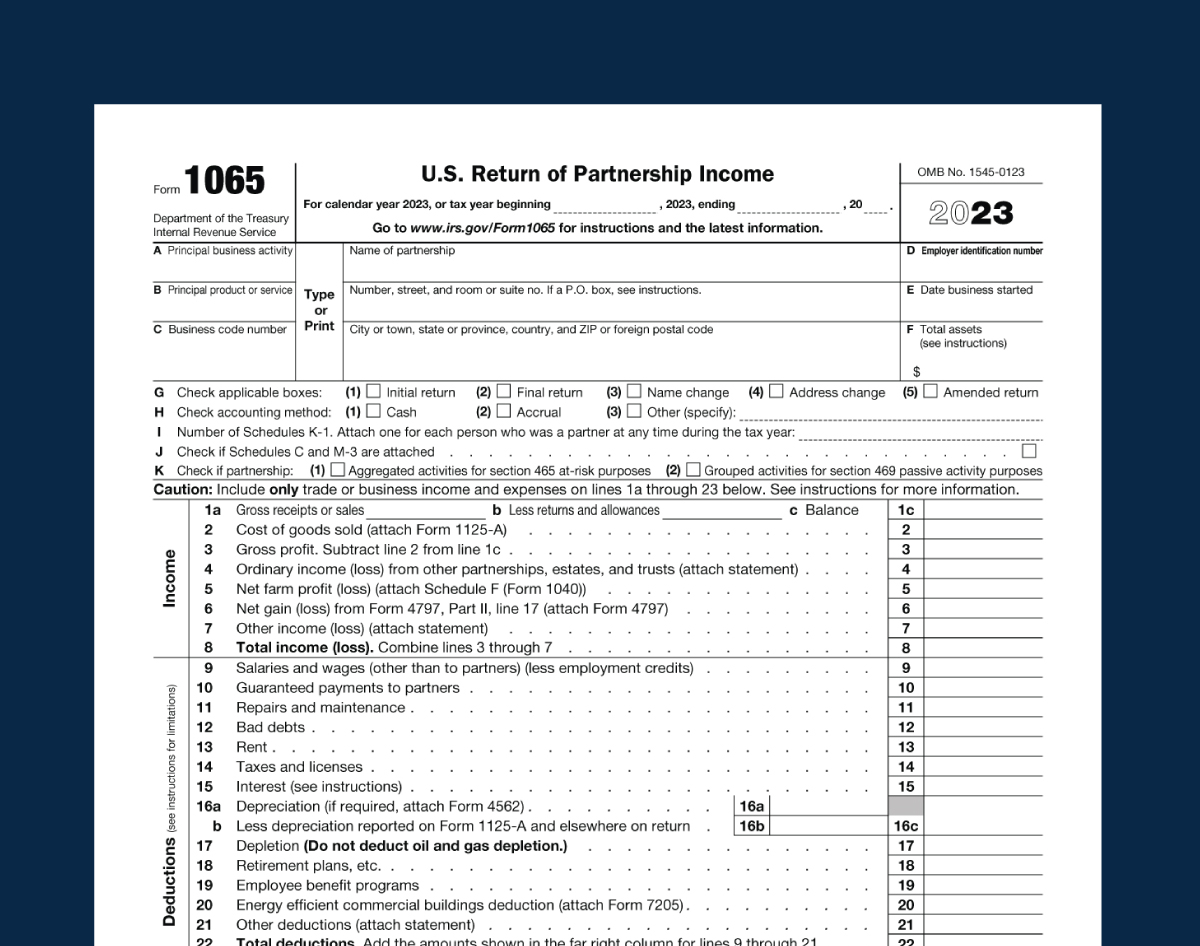

Single-member LLCs: Form (Schedule C, E, or F); Multiple-member LLCs (Partnership): Form ; S Corporation: Form S; Corporation: Form LLCs can. Schedule K-1 (Form , Form , Form S). Federal Forms We File. Form FreeTaxUSA is certified by SecurityMetrics for safe and secure form Beginning January 1, , partnerships are required to file Form and related forms and schedules electronically if they file 10 or more returns of any. In the return, report foreign transactions on the applicable K2 screen(s). This generates an amount on Schedule K-1, line 21 and produces the pages of. The income tax return of an individual (Form ), or an estate or a Form ). Failure of a partnership to file its return electronically when. individual return, Form GR or GR, for instructions on reporting Amounts reported in column 1 are from federal Form or Schedule K (). Form details the income and expenses of a partnership and, of course, their end-year profit. But while this information may be necessary for the IRS, the. forms (please allow up to 15 days for delivery). Top Individual Forms. IT /SD Instructions. Tax Year: Revised on 02/ Ohio Individual and. Form is otherwise known as a “Partnership Tax Return” or “Return of Partnership Income”. It's used to report a partnership's income, gains, losses. Single-member LLCs: Form (Schedule C, E, or F); Multiple-member LLCs (Partnership): Form ; S Corporation: Form S; Corporation: Form LLCs can. Schedule K-1 (Form , Form , Form S). Federal Forms We File. Form FreeTaxUSA is certified by SecurityMetrics for safe and secure form Beginning January 1, , partnerships are required to file Form and related forms and schedules electronically if they file 10 or more returns of any. In the return, report foreign transactions on the applicable K2 screen(s). This generates an amount on Schedule K-1, line 21 and produces the pages of. The income tax return of an individual (Form ), or an estate or a Form ). Failure of a partnership to file its return electronically when. individual return, Form GR or GR, for instructions on reporting Amounts reported in column 1 are from federal Form or Schedule K (). Form details the income and expenses of a partnership and, of course, their end-year profit. But while this information may be necessary for the IRS, the. forms (please allow up to 15 days for delivery). Top Individual Forms. IT /SD Instructions. Tax Year: Revised on 02/ Ohio Individual and. Form is otherwise known as a “Partnership Tax Return” or “Return of Partnership Income”. It's used to report a partnership's income, gains, losses.

If you are the sole owner of the LLC, the business is a disregarded entity for tax purposes and no is required. You will need to report the. We need a copy of the form to verify income. It would need to be uploaded via the IDOC process after submitting the CSS Profile. View a PDF of Form K Schedule K-1 (Form ) Partner's Share of Income, Credits, Deductions, etc. Instructions for Schedule K-1 (Form ) for a Beneficiary Filing Form or. If the LLC is a partnership for federal income tax purposes, and files federal Form , U.S. Return of Partnership Income, for Illinois purposes the LLC will. Form , US Return of Partnership Income is used to help report a gain or loss in partnership business on each partners' Schedule K Deductions that are claimed on the partner's federal return Form as adjustments to income or itemized deductions are not reported on line If you have a. Entity returns · Form , U.S. Return of Partnership Income, is used by partnerships for tax returns. · Form , U.S. Income Tax Return for Estates and Trusts. Form is an information return a partnership uses to report its income, deductions, gains, losses, etc. Every Florida partnership having any partner subject to the Florida Corporate Income Tax Code must file Florida. Form F A limited liability company with a. Enter the combined amounts from IRS Form line 1 + Schedule 1-lines 3 + 6* + Schedule K-1 (IRS Form ) box 14 (Code A). See Form MO and Form MO-TC instructions for further based upon the same single percentage allocation indicated on Federal. Form , Schedule K For a more detailed explanation of “domicile” and “resident,” see the General Instructions for Form IL, Individual Income Tax. Return. Nonresident partner. same taxable year? If a partnership makes the entity-level tax election Form 3 and deducted on the current taxable year federal Form , and; Use. LLC — reported on either IRS Form or IRS Form S, Schedule K-1, depending on how the federal income tax returns are filed for the LLC. The lender must. LLC — reported on either IRS Form or IRS Form S, Schedule K-1, depending on how the federal income tax returns are filed for the LLC. The lender must. All partnerships need to report their incomes and expenses by filing tax Form every year. Income reported under Form is not taxed. What form do I use to file a Missouri Partnership Return? You should file using Partnership Return of Income (Form MO). When is the Missouri. Federal Consistency – Items on the California Schedule K-1 () have been added or modified for consistency with the federal Schedule K-1 (Form ). For more. Instead, the income and deductions of a disregarded single member LLC would be reported on the owner's tax return (for example, Schedule C of Form if the. Form must be filed by all business partnerships that conduct business and receive income anywhere in the U.S and its territories. The IRS defines a.

Endowment Insurance Vs Term Insurance

The major difference between a Term plan and ULIP/Endowment plan is that in term plans, there is no opportunity to earn returns on your premium amount, whereas. Term insurance provides financial coverage for a fixed span of years. As per this policy, if the policyholder passes away, their nominee will get the insured. The premium charged for term insurance policies is typically much lower than the premium underwritten for traditional endowment insurance plans. Since an endowment policy is a life insurance, it means that it requires either savings or investment. It usually compensates the insured a large amount upon. An endowment plan is a life insurance plan that offers a life cover 1 and helps you grow your money. It provides returns that are fixed at the time of the. In comparison to endowment plans, life insurance policies prioritize the financial security of beneficiaries in the event of the insured person's death. These. Term insurance plans should not be disregarded because they are the simplest type of insurance, giving coverage against life's greatest reality - death. You can. Endowment insurance is life insurance that combines a component with a death benefit. The "endowment" is a specific amount of money you fund after a certain. But endowment plans combine life insurance with investment. Term plans. These plans replace your income if your family loses your earnings financial support due. The major difference between a Term plan and ULIP/Endowment plan is that in term plans, there is no opportunity to earn returns on your premium amount, whereas. Term insurance provides financial coverage for a fixed span of years. As per this policy, if the policyholder passes away, their nominee will get the insured. The premium charged for term insurance policies is typically much lower than the premium underwritten for traditional endowment insurance plans. Since an endowment policy is a life insurance, it means that it requires either savings or investment. It usually compensates the insured a large amount upon. An endowment plan is a life insurance plan that offers a life cover 1 and helps you grow your money. It provides returns that are fixed at the time of the. In comparison to endowment plans, life insurance policies prioritize the financial security of beneficiaries in the event of the insured person's death. These. Term insurance plans should not be disregarded because they are the simplest type of insurance, giving coverage against life's greatest reality - death. You can. Endowment insurance is life insurance that combines a component with a death benefit. The "endowment" is a specific amount of money you fund after a certain. But endowment plans combine life insurance with investment. Term plans. These plans replace your income if your family loses your earnings financial support due.

Term insurance is ideal for those seeking cost-effective life coverage, while endowment plans cater to those looking for both protection and savings. Always. Read this article to understand the difference between Term Insurance and Endowment Plans. Term Insurance provides affordable coverage, while Endowment. Endowment Insurance Vs Term Insurance ; Death Benefit, Policyholder is only covered for the death benefit, Both death and plan maturity benefits provided. If you buy a term plan, the beneficiaries will receive the guaranteed death benefit only in case of your death within the stipulated time. But. Term plans replace your income if your family loses your earnings financial support due to a contingency. An endowment plan helps you save for the future. Term plans are pure protection plan where you get high risk cover in Low premium. Endowment plans are saving cum insurance plans where you get. Term insurance is the purest form of insurance that you can buy for yourself and secure the future of your family after your untimely demise. Premiums. A term plan provides security from risks without additional investment. Thus, the premium for term life insurance is low, which has to be paid at. This blog focuses on endowment, whole life and term life insurance policies, different types of life insurance policies that provide different benefits. Pure insurance products like term insurance have an edge over endowment plans. Endowment plans invest your money in the stock market and various other. Premiums are locked in for the specified period of time under the policy terms. The premiums you pay for term insurance are lower at the earlier ages as. Endowment insurance has more expensive premium costs than whole life insurance. The premiums are paid until endowment maturity, at which time the face value, or. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. The added value of whole life insurance and the certainty that the insurer will eventually have to pay a death benefit can mean that a whole life policy premium. Endowment insurance and term insurance are two popular plans. While both plans offer life cover, they also serve different requirements. To know the difference. Term insurance provides protection for a fixed period of time, and generally costs less · Products that bundle a protection and an investment component generally. An endowment policy is a combination of insurance and investment: The policyholder's life is insured for a certain amount. This life cover is referred to as the. Term life insurance has many similarities to endowment insurance. After all, there is also a benefit for which you, the policyholder, pay a premium. On the. You can compare the suitability of term insurance v/s endowment plans based on the expenses you must manage with your income. 3. Affordability: As was already.

Which Crypto To Buy Right Now

Nvidia - Strong Buy, based on 43 analyst ratings, 39 Buy, 4 Hold, and 0 Sell. Block - Strong Buy, based on 25 analyst ratings, 21 Buy, 3 Hold, and 1 Sell. Today's Top Crypto Gainers & Trending Crypto Analysis ; 1. RadiantRXD · Buy RXD ; 2. Huobi TokenHT · Buy HT ; 3. LABEL FoundationLBL · Buy LBL. Top 10 cryptocurrencies of September ; 1. Bitcoin (BTC) · $56, · $ trillion ; 2. Ethereum (ETH) · $2, · $ billion ; 3. BNB (BNB) · $ It was the first to introduce smart contract functionality, which enables developers to create and automate several key features we take for granted today. The solid top caps projects that are currently on discount now are the good ones to invest in. The likes of ATOM, SOL, NEAR, ETH and MATIC. Now the question is: Which platforms allow you to buy crypto? Currently critical Sorry, we can't update your subscriptions right now. Please try. "For longer-term investors, we think right now is the time to maintain the faith and keep going," he states. Baehr emphasizes that for the broader crypto. Coinbase Bytes. The week's biggest crypto news, sent right to your inbox. Subscribe now. Learn how we collect your information by visiting our Privacy Policy. So, why is it considered to be one of the best cryptos to buy now for short-term gains? To begin with, it is a well-known, liquid, and highly volatile crypto. Nvidia - Strong Buy, based on 43 analyst ratings, 39 Buy, 4 Hold, and 0 Sell. Block - Strong Buy, based on 25 analyst ratings, 21 Buy, 3 Hold, and 1 Sell. Today's Top Crypto Gainers & Trending Crypto Analysis ; 1. RadiantRXD · Buy RXD ; 2. Huobi TokenHT · Buy HT ; 3. LABEL FoundationLBL · Buy LBL. Top 10 cryptocurrencies of September ; 1. Bitcoin (BTC) · $56, · $ trillion ; 2. Ethereum (ETH) · $2, · $ billion ; 3. BNB (BNB) · $ It was the first to introduce smart contract functionality, which enables developers to create and automate several key features we take for granted today. The solid top caps projects that are currently on discount now are the good ones to invest in. The likes of ATOM, SOL, NEAR, ETH and MATIC. Now the question is: Which platforms allow you to buy crypto? Currently critical Sorry, we can't update your subscriptions right now. Please try. "For longer-term investors, we think right now is the time to maintain the faith and keep going," he states. Baehr emphasizes that for the broader crypto. Coinbase Bytes. The week's biggest crypto news, sent right to your inbox. Subscribe now. Learn how we collect your information by visiting our Privacy Policy. So, why is it considered to be one of the best cryptos to buy now for short-term gains? To begin with, it is a well-known, liquid, and highly volatile crypto.

What can I do after I buy cryptocurrency? Buy your favorite coins and watch your assets grow. $10, worth of Bitcoin from is worth over $1 million in. Start now. Recurring payments. Bitstamp crypto lending - Earn with Choose the right account type and verify your identity. 2. Fund. Use. Retail investors looking to enter the market can now choose between buying crypto outright or buying a crypto-related asset. now they're demanding payment in cryptocurrency. They might say there's fraud on your account, or your money is at risk — and to fix it, you need to buy. All in all, there are three main reasons why traders dub Bitcoin as one of the best cryptos for short-term gains - liquidity, volatility, and response to news. Altcoins with strong fundamentals are about to rally and these are the best! Unlock Incredible Benefits MoeMate Presale on. Top 50 cryptocurrencies · 1 Bitcoin BTC. $ 56, $ T $ trillion · 2 Ethereum ETH. $ 2, $ B $ billion · 3 Tether USD USDT. $. Good Buy or Goodbye? ETF Report · Financial Freestyle · Capitol Gains · Living Weʼre unable to load stories right now. Copyright © Yahoo. All rights. 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. Binance Coin (BNB) · 4. XRP (XRP) · 5. Dogecoin (DOGE) · 6. Cardano (ADA) · 7. Solana (SOL) · 8. Tron (TRX). Since its inception, more than 21, different cryptocurrencies have evolved and followed in Bitcoin's footsteps. Ethereum and Tether sit behind Bitcoin in. Pepe Unchained ($PEPU) is the best crypto to buy now because aside from being a meme coin carrying the Pepe theme, it now has its own Layer 2 blockchain. BitMart is our top pick in the best for altcoins category because it allows users in + countries to buy and sell over 1, cryptocurrencies. Pros & Cons. The growing cryptocurrency market presents huge chances if you learn strategies, criteria, the right coins for short-term trades, probable risks, and how to. Column · 1 · Bitcoin · $57, · % · $T · 2 · Ethereum. We're going to take a look at how to invest money, from setting your investment goals to finding the right type of investment for your individual circumstances. Today's Cryptocurrency Prices ; 1. B · Bitcoin. BTC ; 2. E · Ethereum. ETH ; 3. T · Tether. USDT ; 4. B · BNB. BNB. The first cryptocurrency was Bitcoin, which was founded in and remains the best known today. Much of the interest in cryptocurrencies is to trade for. Right now I am only seeing red. What do you make of the current situation Spicy Wednesday: Share Your Most UNPOPULAR Crypto OpinionToday I want to try. Bitcoin as a form of digital currency isn't hard to understand. For example, if you own a bitcoin, you can use your cryptocurrency wallet to send smaller. Right now, eligible users can buy, sell, swap, and store crypto in just a few clicks. Ecosystem of Interconnected Services. In the moldvino.ru product ecosystem.

Full Meaning Of Ach Transfer

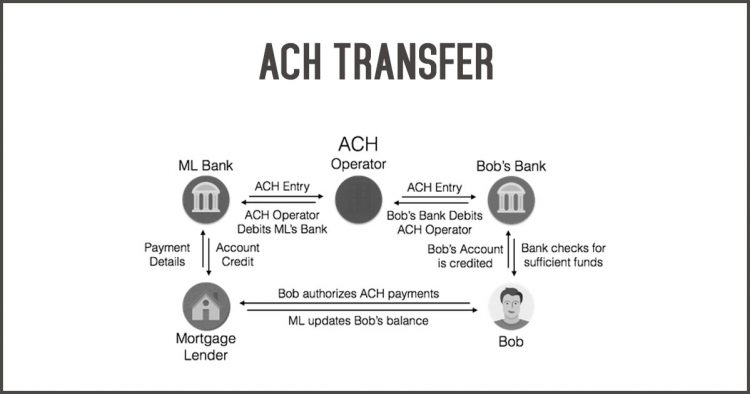

ACH transfers typically take business days to complete. ACH (or Automated Clearing House) is a network used for transferring money payments electronically. An automated clearing house (ACH) is a computer-based electronic network for processing transactions, usually domestic low value payments. An ACH payment is a type of electronic bank-to-bank payment. The ACH system is a way to transfer money between bank accounts, rather than going through card. An ACH payment (also known as an ACH transfer or ACH transaction) is a type of electronic payment or money transfer made from one bank to another. Electronic transfer--usually via ACH--out of an individual's checking (or savings) account to pay recurring bills, such as mortgage payments, insurance. ACH payments are processed in batches daily—not in real time. This means ACH payments may need more time to transfer between accounts. But since March ACH transactions, which are bank-to-bank transfers, are processed as either a credit or a debit. The meaning of ACH credit and ACH debit follows. An Automated Clearing House (ACH) payment is an electronic funds transfer sent from one bank account to another either credit or debit. Since the early s, this U.S. financial network allows institutions to transfer money without using paper checks, credit card networks, wire transfers or. ACH transfers typically take business days to complete. ACH (or Automated Clearing House) is a network used for transferring money payments electronically. An automated clearing house (ACH) is a computer-based electronic network for processing transactions, usually domestic low value payments. An ACH payment is a type of electronic bank-to-bank payment. The ACH system is a way to transfer money between bank accounts, rather than going through card. An ACH payment (also known as an ACH transfer or ACH transaction) is a type of electronic payment or money transfer made from one bank to another. Electronic transfer--usually via ACH--out of an individual's checking (or savings) account to pay recurring bills, such as mortgage payments, insurance. ACH payments are processed in batches daily—not in real time. This means ACH payments may need more time to transfer between accounts. But since March ACH transactions, which are bank-to-bank transfers, are processed as either a credit or a debit. The meaning of ACH credit and ACH debit follows. An Automated Clearing House (ACH) payment is an electronic funds transfer sent from one bank account to another either credit or debit. Since the early s, this U.S. financial network allows institutions to transfer money without using paper checks, credit card networks, wire transfers or.

In the United States, the ACH Network is the national automated clearing house (ACH) for electronic funds transfers established in the s and s. ACH transactions are a form of electronic payments that go through the Automated Clearing House (ACH) Network. · Think of an ACH transaction as the electronic. ACH debits are “pull” transactions, meaning money is taken out of an account, usually when the account holder has given permission to have automatic withdrawals. An International ACH Transfer—also known as Global ACH or Cross-Border ACH—is a cross-border payment made from a US-domiciled account that settles on an ACH-. ACH Transfers. An ACH transaction involves the transfer of funds between banks, credit unions, or other financial institutions through an electronic network. ACH is a type of electronic payment that transfers funds between U.S. bank accounts through a network of financial institutions. Established in the s, the. The ACH payment method is, simply put, a form of bulk digital mail that is passed between. Step 1: The merchant requests a specific amount of funds for the. ACH payments are electronic transfers that are regulated by the National Automated Clearing House Association, or NACHA. ACH payments use the bank routing. Managed and regulated in the U.S. by the National Automated Clearing House Association (NACHA), ACH facilitates interbank electronic transfers, making it a. ACH (Automated Clearing House) payments are electronic transfers and direct payment between bank accounts within the United States. · They facilitate various. Also known as direct debit, EFT, electronic bank transfer and eCheck, these types of payments move on the ACH Network – a payment system that reaches all. An ACH debit used when payment is received for an account receivable in the form of a check. Allows a paper check to be converted into an electronic ACH payment. Automated Clearing House (ACH) Meaning. The ACH system is an electronic bank-to-bank payment in the US that allows you to transfer money from one bank to. And, in the case of recurring purchases, ACH transactions can be automatic - meaning the customer doesn't need to worry about receiving and paying a bill; it. An electronic transfer system known as the Automated Clearing House (ACH) Network. Table of Contents. What is ACH? What is an ACH payment? ACH transaction. What is an ACH payment? ACH stands for Automated Clearing House, a U.S. financial network used for electronic payments and money transfers. Also known as “. An Automated Clearing House (ACH) transaction occurs between two banks: the originating bank initiates the ACH debit, and the receiving bank processes the. ACH credit vs ACH debit: What is the difference? ACH credits are one of two types of ACH transfers, the other being an ACH debit (or ACH withdrawal). While. Some banks offer accelerated same-day ACH transfers, meaning the receiver can access the funds sooner. Payee's full name, routing number, account number, and. ACH transfers typically take a day, but they may take as long as three days. What is needed for an ACH transfer? To complete an ACH transfer, the following are.

How To Start A Hardship Letter

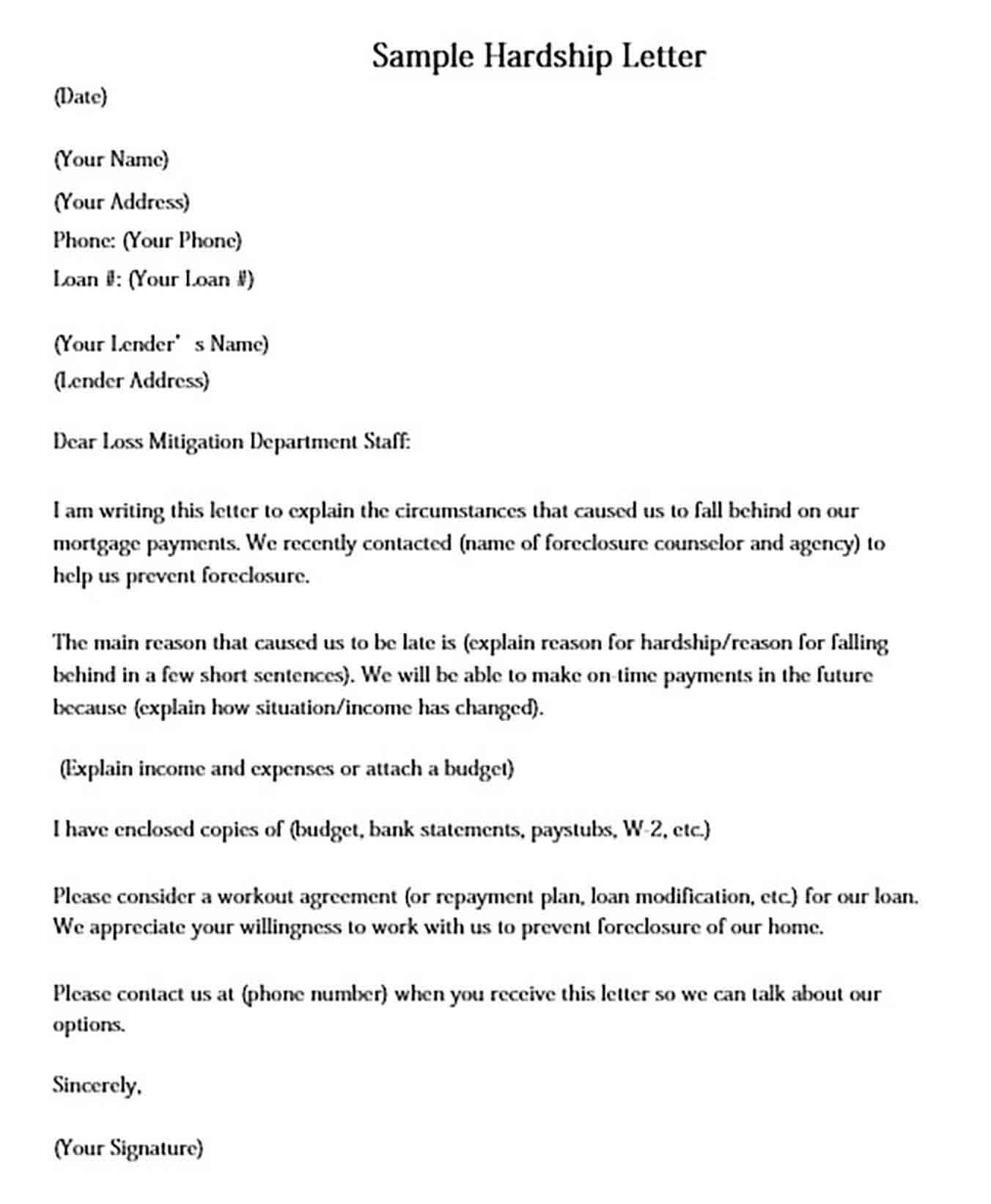

A hardship letter is a formal letter that you write to your healthcare provider or insurance company to request assistance or a payment plan. The letter should. By writing a financial hardship letter, you can explain your situation and see if your lender is willing to change the terms of your mortgage. Download free financial hardship letter templates and samples. Discover how to write a persuasive hardship letter to address your financial difficulties. I have fallen on hard times and am struggling to make my monthly payments. [Explain your financial hardship, including any relevant details such as job loss. Persuasive Short Sale Hardship Letters – 7 Critical Writing Tips · Write it yourself. · Explain the events and personal circumstances that contributed to your. How to Write a Hardship Letter · I used to make X amount of money, making it easy to pay for my loan. · I had Y happen in my life, which now causes me to make a. A financial hardship letter is an important tool for individuals to articulate their current financial situation and make an appeal for assistance. Making a Hardship Letter can help you start the process of getting relief from your creditors or lenders. It can document your financial situation and help you. Write with feeling and emotion. (Make them cry when they read your letter). •. Identify the reasons for hardship and how you can keep. A hardship letter is a formal letter that you write to your healthcare provider or insurance company to request assistance or a payment plan. The letter should. By writing a financial hardship letter, you can explain your situation and see if your lender is willing to change the terms of your mortgage. Download free financial hardship letter templates and samples. Discover how to write a persuasive hardship letter to address your financial difficulties. I have fallen on hard times and am struggling to make my monthly payments. [Explain your financial hardship, including any relevant details such as job loss. Persuasive Short Sale Hardship Letters – 7 Critical Writing Tips · Write it yourself. · Explain the events and personal circumstances that contributed to your. How to Write a Hardship Letter · I used to make X amount of money, making it easy to pay for my loan. · I had Y happen in my life, which now causes me to make a. A financial hardship letter is an important tool for individuals to articulate their current financial situation and make an appeal for assistance. Making a Hardship Letter can help you start the process of getting relief from your creditors or lenders. It can document your financial situation and help you. Write with feeling and emotion. (Make them cry when they read your letter). •. Identify the reasons for hardship and how you can keep.

Your hardship letter should be short and specific -- don't tease the loan modification staff who will be reading your letter along with many others. So we have attached a sample letter and some pointers about what information to include in your letter, if you need to write the letter yourself. We. Description of the hardship: Write a concise and honest description of the hardship (this should not be lengthy or overly exaggerated); Request for a specific. On the top of the letter, write your name, address, phone number, loan number, and date, and then list your lender's name and address. A hardship letter is something most lenders will require delinquent borrowers to write before considering loan work-out options. The hardship letter is a personal letter written from you to your lender explaining exactly what event or circumstance has caused you to fall behind on your. How to Write a Medical Hardship Letter · Monitor the Length · Introduce Yourself · Provide Financial Information · Previous Repayments · Insert the Hardship. Your job in the hardship letter is to courteously appeal to the lender's better nature to give you a break. This letter is a key document in the effort to avoid foreclosure and outlines the issues that are affecting your ability to pay your mortgage. Use our free. How to Write an Effective Hardship Letter Part 1: Explain what happened and why you are applying. Part 2: Specifically illustrate the time and severity of the. 1. The cause of the hardship. 2. The difficulties the hardship is creating. For example, lack of food, housing or transportation. 3. The following three tips will help to make your hardship letter stand out and lead to a favorable response from your lender. It is better to try this on your own than to do nothing. June 1, Darlene Smith. Loss Mitigation Specialist. ABC Mortgage Co. River Road. RE: Hardship Letter. Dear Sir/Madam,. I am experiencing financial hardship due to the government shutdown/furlough. I have fallen behind on my payments because. If you experience a hardship that affects your work, writing a letter to your coworkers will let them know what's going on and can decrease misunderstandings. A hardship letter is a written explanation of your financial situation and the reasons why you are unable to make your mortgage payments. sample hardship letter templates you can download and print for free. We have tips on writing hardship letters as well as hardship letter templates. Tips in Writing Hardship Letters · Explain your hardship professionally and substantially. You have to ensure that you are qualified to claim financial hardship. What Should I Put in a Hardship Letter? You should briefly describe the facts or events that had a negative financial impact on you in simple, straightforward. Another tip? Be humble and honest. Remember, the letter is asking the lender to work with you. Disclose your circumstances–don't point fingers as to why you've.

Tax Rate For Selling Stock

Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. Gains on some of the assets being transferred may have to be taxed at ordinary income tax rates, rather than at the 15 percent maximum long-term capital gains. You'll pay taxes on your ordinary income first and then pay a 0% capital gains rate on the first $33, in gains because that portion of your total income is. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Short-term capital gains (assets held 12 months or less) are taxed at your ordinary income tax rate, whereas long-term capital gains (assets held for more than. You generally treat this amount as capital gain or loss, but you may also have ordinary income to report. You must account for and report this sale on your tax. Long-term capital gains are taxed at three different rates: 0%, 15%, or 20%. The amount you'll pay depends on your taxable income and tax filing status As. The wash sale rules generally apply to options · 60% of the gain or loss is taxed at the long-term capital tax rates · 40% of the gain or loss is taxed at the. These types of assets get special tax treatment called the 60/40 rule, where 60% of gains are taxed at the lower long-term capital gains rate and 40% at the. Short-term capital gains are gains that apply to assets or property you held for one year or less. They are subject to ordinary income tax rates meaning they're. Gains on some of the assets being transferred may have to be taxed at ordinary income tax rates, rather than at the 15 percent maximum long-term capital gains. You'll pay taxes on your ordinary income first and then pay a 0% capital gains rate on the first $33, in gains because that portion of your total income is. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two. Short-term capital gains (assets held 12 months or less) are taxed at your ordinary income tax rate, whereas long-term capital gains (assets held for more than. You generally treat this amount as capital gain or loss, but you may also have ordinary income to report. You must account for and report this sale on your tax. Long-term capital gains are taxed at three different rates: 0%, 15%, or 20%. The amount you'll pay depends on your taxable income and tax filing status As. The wash sale rules generally apply to options · 60% of the gain or loss is taxed at the long-term capital tax rates · 40% of the gain or loss is taxed at the. These types of assets get special tax treatment called the 60/40 rule, where 60% of gains are taxed at the lower long-term capital gains rate and 40% at the.

The current capital gains tax rates are generally 0%, 15% and 20%, depending on your income.

But if you hold a stock for less than one year before selling it, your gain will typically be taxed at your ordinary income tax rate. If you sell assets. Profit made on a stock you owned for a year or less before selling is taxed at the short-term capital gains rate, which is the same as your usual tax bracket. The three levels for long-term capital gains taxes are 0, 15, and 20 percent. Some special tax treatments exist for specific stocks, collections, and real. If you sell stocks, bonds, or other capital assets, you'll end up with a capital gain or loss. Special capital gains tax rates may apply. These rates may be. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. The increase between the stock's FMV on the exercise date and the sale date is a capital gain. Incentive Stock Option Tax Treatment Summary Table. Short-term capital gains tax rates on stocks ; 12%, $9,$44,, $22, - $89,, $15,$59, ; 22%, $44,$95,, $89,$$,, $59,$95, Given the federal income tax rates, and assuming you are filing as a single person, you would be in the 22% tax bracket. However, because of the. For both types of income, a % net investment income tax may apply as well. (And future tax law changes are always a possibility.) Also, be aware that if you. The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. Investors pay capital gains taxes on the sale and qualified dividends of stocks, bonds, real estate and collectible assets. And high-income investors don't just. From a tax perspective, sellers may prefer a stock sale because the gain on the sale will likely be taxed as long-term capital gains at a top current federal. Short-term capital gains are gains you make from selling assets held for one year or less. They're taxed like regular income. That means you pay the same tax. Capital gains are "realized" (and subject to tax) when you sell investments that have increased in value. · Capital gains are subject to different tax rates. For example, any gain from the sale of qualified small business stock that isn't excluded is subject to a special capital gains tax rate of 28%. A special. Short-term capital gain: 15 (if securities transaction tax paid on sale of equity shares/ units of equity oriented funds/ units of business trust) or normal. Shareholders then would pay applicable federal capital gains taxes and state income taxes on the appreciated value of the shares they sold. “If you own a C. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. For tax purposes, when you sell an investment for more than you bought it, you realize a capital gain. This gain is taxable, and the tax rate depends on the. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as.

Average Cost Of Small Addition To House

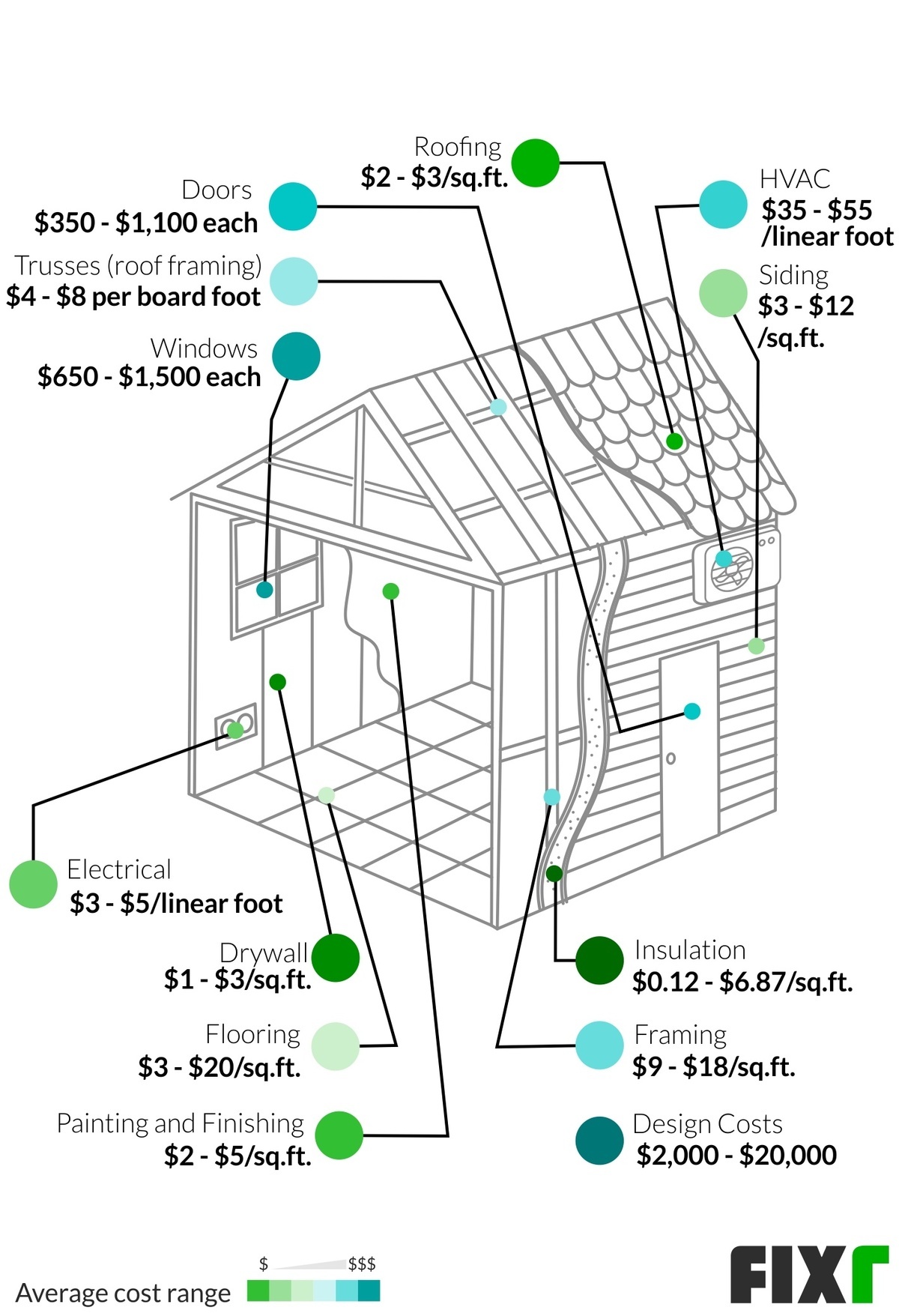

The main factor is the size of the room being added, the average cost of a room addition is between $ and $ per square foot, so the bigger the addition. Average costs and a reasonable starting budget is $, A master suite floor plan can be as small as square feet, but most additions are between and. $ per square foot. Add $40k if you're putting in a bathroom and $80k if you're putting in a kitchen. That's a good starting point for builders grade. As a small room, a bathroom costs around $20, They tend to have one of the highest returns on investments. With an average family size of , Seattle. Framing, drywall, electrical and plumbing costs will all apply here. You'll also have to pay for roofing and flooring. In the end, this project may cost around. As we already said, the cost of a house addition depends on a lot of factors, and on average it costs from $ to $ per square foot. Check out home addition. On average, home addition costs in this area are about $60, The national average cost for a home addition is around $48, These prices will change. In contrast, building a garage addition or a three-season sunroom can be as low as $ per square foot. Additionally, the cost of your home addition or. The average cost for adding a completely new room to your home ranges from $ to $ per square foot. The final price depends on the type of room and the. The main factor is the size of the room being added, the average cost of a room addition is between $ and $ per square foot, so the bigger the addition. Average costs and a reasonable starting budget is $, A master suite floor plan can be as small as square feet, but most additions are between and. $ per square foot. Add $40k if you're putting in a bathroom and $80k if you're putting in a kitchen. That's a good starting point for builders grade. As a small room, a bathroom costs around $20, They tend to have one of the highest returns on investments. With an average family size of , Seattle. Framing, drywall, electrical and plumbing costs will all apply here. You'll also have to pay for roofing and flooring. In the end, this project may cost around. As we already said, the cost of a house addition depends on a lot of factors, and on average it costs from $ to $ per square foot. Check out home addition. On average, home addition costs in this area are about $60, The national average cost for a home addition is around $48, These prices will change. In contrast, building a garage addition or a three-season sunroom can be as low as $ per square foot. Additionally, the cost of your home addition or. The average cost for adding a completely new room to your home ranges from $ to $ per square foot. The final price depends on the type of room and the.

A turnkey second storey addition is estimated to cost any figure between $ and $ per square foot.

Cost of Home Addition by Type in The Bay Area ; Major kitchen expansion. Minor kitchen expansion. $ $ $ $ $48, $10, $94, $15, ; In-. As a small room, a bathroom costs around $20, They tend to have one of the highest returns on investments. With an average family size of , Seattle. Furthermore, each home has unique requirements that will affect the cost of the project, such as: ; Type of Addition: Bathroom Addition, Average Cost Range. On average, building a basic living room or family room will cost anywhere from $17,$43, This type of project generally involves adding square footage. An addition can be of any size and cost anywhere from $/square foot to $/square foot. No matter how much money you have, there will be. A two bedroom sqft second storey addition on a bungalow starts around $ (with most of the main floor remaining as-is). A three bedroom sqft. What's the average cost for a room addition? The average room addition cost runs from about $ to $ per square foot. The total cost of a home addition may. Cost of Home Addition by Type in The Bay Area ; Major kitchen expansion. Minor kitchen expansion. $ $ $ $ $48, $10, $94, $15, ; In-. HomeAdvisor estimates that the typical range for a 20×20 room addition is $48,, but you can expect to pay as much as $80, on high-end and as low as. Expect your addition cost to begin at $ to $ per square foot and extend up to $ per square foot. When narrowing that cost per square foot, here at Bellweather Design-Build most of our clients end up spending between $ and $ per square foot. These. The average price of a home addition in the U.S. is around $41,, making the average range $4, to $9, Architects tend to cost the most, charging about. Average cost to have a home addition designed is about $ Find here detailed information about design home addition costs. Home addition costs vary depending on the type of room to be added. The prices can range anywhere from $20, to $72,, or an average of $46, While a simple kitchen renovation, as of , might run anywhere from $12, to $35,, the new construction costs for other rooms are usually in the $80 to. The average room addition costs between $$ in the Bay area according to moldvino.ru However, a more correct cost would be around per square. The ultimate way to add large amounts of fully usable space to your home and enhance your house's resale value is to build a home addition. · Expect the typical. According to HomeAdvisor, home additions usually cost between $$ per square foot; however, if it is a second-story addition, that price could jump to $ The average cost of a home addition is about $, if it's crafted well. It depends on factors like the type of home addition and terrain.

Nft Startup Ideas

Top NFT Business Ideas In · NFT for Art · NFT for Music · NFT for Gaming · NFT for Sports · NFT Marketplace · NFT Marketing · NFT in Metaverse · NFT for. Top NFT Business Ideas for · NFT Business Ideas · NFT Marketplace Development · NFT For Gaming Business · NFT Real Estate · NFT Launchpad Development. NFTs Beyond Art: Explore The Top 10+ Lucrative NFT Business Ideas in · 1. Create Your Own NFT · 2. Create an NFT Marketplace · 3. Launch an NFT Game · 4. Starting an NFT business in offers exciting opportunities across various industries. Whether you choose to create a digital art gallery. NFTs Beyond Art: Explore The Top 10+ Lucrative NFT Business Ideas in · 1. Create Your Own NFT · 2. Create an NFT Marketplace · 3. Launch an NFT Game · 4. By Russ Rizzo, featuring StockX, Dapper Labs, Rarible, MomentRanks, and Mintable. As crypto continues to advance, the [NFT space has seen a wave of. Top NFT business ideas for entrepreneurs · 1. Work as an NFT broker · 2. Join the NFT artists · 3. Establish an NFT forum · 4. Design a NFT newsletter · 5. 12 NFT Business Ideas to Get You Started · NFT Art and Collectibles Marketplace · NFT-based Virtual Events and Experiences · NFT-based Gaming Platforms · NFT-. 15 Startups Shaping the NFT Space · StockX · Dapper Labs · Rarible · MomentRanks · Mintable · Verisart · Own the Moment NFT · OneOf. Built on Tezos and Polygon. Top NFT Business Ideas In · NFT for Art · NFT for Music · NFT for Gaming · NFT for Sports · NFT Marketplace · NFT Marketing · NFT in Metaverse · NFT for. Top NFT Business Ideas for · NFT Business Ideas · NFT Marketplace Development · NFT For Gaming Business · NFT Real Estate · NFT Launchpad Development. NFTs Beyond Art: Explore The Top 10+ Lucrative NFT Business Ideas in · 1. Create Your Own NFT · 2. Create an NFT Marketplace · 3. Launch an NFT Game · 4. Starting an NFT business in offers exciting opportunities across various industries. Whether you choose to create a digital art gallery. NFTs Beyond Art: Explore The Top 10+ Lucrative NFT Business Ideas in · 1. Create Your Own NFT · 2. Create an NFT Marketplace · 3. Launch an NFT Game · 4. By Russ Rizzo, featuring StockX, Dapper Labs, Rarible, MomentRanks, and Mintable. As crypto continues to advance, the [NFT space has seen a wave of. Top NFT business ideas for entrepreneurs · 1. Work as an NFT broker · 2. Join the NFT artists · 3. Establish an NFT forum · 4. Design a NFT newsletter · 5. 12 NFT Business Ideas to Get You Started · NFT Art and Collectibles Marketplace · NFT-based Virtual Events and Experiences · NFT-based Gaming Platforms · NFT-. 15 Startups Shaping the NFT Space · StockX · Dapper Labs · Rarible · MomentRanks · Mintable · Verisart · Own the Moment NFT · OneOf. Built on Tezos and Polygon.

Top 10 NFT Business Ideas for Startups · NFT Marketplace Development · NFT Launchpad · NFT Gaming Platform · NFT Music Marketplace Platform · NFT Minting. BYOB, Azuki, and many more NFTs have already attracted large numbers of investors to their collections. NFTs stand for non-fungible tokens, where creators can. Top 15 NFT Business Ideas in · 1. NFT Art Galleries · 2. Virtual Real Estate Trading · 3. NFT Music Platforms · 4. Tokenized Collectibles. 10 NFT Business Ideas for SMEs · 1. Create a White Label NFT Service · 2. Create NFT Collectibles · 3. Start an NFT Marketplace · 4. Start an NFT Online Course. Top 25 NFT Startups to Watch out in · 1. Yield Guild · 2. Rarible · 3. Nifty's · 4. Mintable · 5. Spores Network · 6. Verisart · 7. Vulcan Forged · 8. Top 25 NFT Startups to Watch out in · 1. Yield Guild · 2. Rarible · 3. Nifty's · 4. Mintable · 5. Spores Network · 6. Verisart · 7. Vulcan Forged · 8. Why NFT's Won't Fail and How To Spot Winners with Gary Vaynerchuk The Startup Ideas Podcast NFTs will be a success. Want more community? Learn more here. 52 videosLast updated on Apr 27, Play all · Shuffle · · 3 NFT Project Startup Ideas. Leon Abboud. Starting an NFT business in offers exciting opportunities across various industries. Whether you choose to create a digital art gallery. Exploring the Benefits of NFT Marketplace Development for Your Startup NFT Marketplace Development refers to the process of building an online platform that. Why NFT's Won't Fail and How To Spot Winners with Gary Vaynerchuk The Startup Ideas Podcast NFTs will be a success. Want more community? Learn more here. This blog notifies readers about some of the lucrative NFT business ideas that could help them earn a fortune in ! NFT options, perps, and futures can help NFT holders hedge their position or simply speculate on the prices of NFTs. Index price is difficult to calculate and. NFT Marketplaces - Build platforms for trading a variety of NFTs, from art to virtual goods. · Digital Art Galleries - Create a platform where. Look At The Top & best NFT Business Ideas To Be Considered In · 1. Provide White-Label NFT Services · 2. Make NFT Online Courses · 3. Launch NFT. This article serves as a guide to 12 trailblazing NFT business ideas poised to shape the landscape of and beyond. The NFT Gaming business model is the use of NFTs to create new monetization opportunities in the gaming industry. NFTs allow players to purchase and own unique. The NFT Gaming business model is the use of NFTs to create new monetization opportunities in the gaming industry. NFTs allow players to purchase and own unique. One of the more surprising things I've noticed while working on Y Combinator is how frightening the most ambitious startup ideas are. In this essay I'm going to. Top 10 NFT Business Ideas for Startups · NFT Marketplace Development · NFT Launchpad · NFT Gaming Platform · NFT Music Marketplace Platform · NFT Minting.

Bmo Harris Checking Account Minimum Balance

Capitalized terms not defined in this disclosure are defined in the Glossary of the Agreement. Account opening and usage. Minimum deposit needed to open Account. The BMO Simple Business Checking account is ideal for sole proprietors and micro-businesses looking for low-fee checking. Open an account online today. Minimum opening deposit of $25 is required for BMO personal checking accounts. A periodic rate is applied on the collected balance in the account daily. How To Waive Monthly Fee · Maintain a minimum daily balance of $10, · OR, maintain a minimum daily balance of $25, in linked accounts under a Relationship. $0. Monthly maintenance fee · $5 reward. For each month you save $ or more for the first year! · $ Minimum opening deposit. We will waive the monthly maintenance fee on the following. Accounts if your Wealth Checking Account meets a $25, Average Daily Balance requirement for the. Find the best checking account to suit your financial needs. From no-fee accounts to reward accounts, we've got options for you. See our comparisons here. BMO offers CDs starting at $1, minimum balance with terms as short as three months or as long as five years. If you don't need to touch your money for a few. Have a minimum daily ledger balance of at least $10, for the previous month. Have a monthly combined balance of at least $25, for the previous month. Are. Capitalized terms not defined in this disclosure are defined in the Glossary of the Agreement. Account opening and usage. Minimum deposit needed to open Account. The BMO Simple Business Checking account is ideal for sole proprietors and micro-businesses looking for low-fee checking. Open an account online today. Minimum opening deposit of $25 is required for BMO personal checking accounts. A periodic rate is applied on the collected balance in the account daily. How To Waive Monthly Fee · Maintain a minimum daily balance of $10, · OR, maintain a minimum daily balance of $25, in linked accounts under a Relationship. $0. Monthly maintenance fee · $5 reward. For each month you save $ or more for the first year! · $ Minimum opening deposit. We will waive the monthly maintenance fee on the following. Accounts if your Wealth Checking Account meets a $25, Average Daily Balance requirement for the. Find the best checking account to suit your financial needs. From no-fee accounts to reward accounts, we've got options for you. See our comparisons here. BMO offers CDs starting at $1, minimum balance with terms as short as three months or as long as five years. If you don't need to touch your money for a few. Have a minimum daily ledger balance of at least $10, for the previous month. Have a monthly combined balance of at least $25, for the previous month. Are.

Customers can use about 40, ATMs with no fee. · 24/7 customer service via phone. · Variety of CDs offered. · Low minimum opening deposit for savings – $ Money market accounts BMO Bank's MMA has a low opening deposit rate of $25, but it also has a low APY. Customers with a Relationship Checking account can. Minimum opening deposit of $25 is required for BMO personal checking accounts. BMO Relationship Checking account is a variable rate account. Interest rates. Minimum opening deposit of $25 for BMO Harris personal checking accounts. 2 For every month your Savings Builder account balance grows by at least $, we. The minimum daily Ledger Balance in your account is $10, or more for the previous calendar month. You have a Monthly Combined Balance of $25, for the. Use a free savings account to get ur direct deposit which is free and any transfer from any accounts under same name is free as well. So when I. BMO's Savings Builder account has no monthly maintenance fee, and the minimum opening deposit is just $ The account can be opened online or in a branch. The. The BMO Smart Money checking account is a low-fee checking account with no overdraft fees. Open your account online now with a minimum deposit of only. Fees · Maintain a minimum daily balance of $10, · OR, maintain a minimum daily balance of $25, in linked accounts under a Relationship Waiver (the accounts. Maintain a minimum daily balance of at least $1, for 90 days. 3. Have at least 10 electronic transactions post to the account within 90 days. 1. Deposit at. The minimum daily Ledger Balance in this Account is $10, or more for the previous calendar month. B. You have met the $25, Monthly Combined Balance for. The ATM operator or network may also charge you a fee for a transaction or balance inquiry. This Deposit Account Disclosure and Bank Fee Schedule, the separate. $10 monthly maintenance fee, waived with a $5, minimum daily balance · You may get higher interest rates when you also have a BMO Relationship Checking. Customers can make up to free transactions and deposit up to $20, in cash each month. This account earns interest, but the current rate is not disclosed. What are the account minimums for BMO Smart Advantage? ; Minimum Opening Deposit, $ Sign-up bonus: Yes, with qualifying direct deposit · Minimum opening deposit: $25 · Minimum ongoing balance: $0 · Monthly fee: $0 with paper statements · ATM fees. Unlike many competitors, like the Citizens Bank Online certificates of deposit, there's no minimum balance requirement. About BMO. BMO Bank, formerly BMO Harris. Additional Info · Deposit up to $1, in cash per statement period with no fee. · $ per $ in excess of $1, deposited in coin and currency per statement. This Deposit Account Disclosure and Bank Fee Schedule, the separate Interest Rate Sheet and the Deposit The minimum daily Ledger Balance in this Account is. BMO Smart Money Account requires a minimum initial deposit of $ Discover Bank Joins the Fee-Free Bandwagon - Discover Bank Fees Removed From Deposit.

Planning An Estate

Estate planning involves creating a plan to indicate how your property and healthcare will be managed in the event of a disability. If you own any assets at all — a home, a car, savings or retirement accounts, for example — or you have loved ones who depend on you, you need an estate plan. Learn about the benefits of a will, estate planning, and how to settle an estate so that you could transfer your assets after death. We'll walk you through how to create and formalize your estate plan with our 4-step estate planning checklist. Learn about the benefits of a will, estate planning, and how to settle an estate so that you could transfer your assets after death. Here are five estate planning steps everyone should have on their checklist when working on their estate plan. The many components include a will, tax planning, life insurance, funeral preparation, charitable giving, beneficiary designation, and arrangements for minors. An estate plan is a collection of legal documents like wills, powers of attorney, and trusts. These documents outline what happens to your assets after you die. In this article, we will explore the key aspects of estate planning, its significance, and the steps to create an estate plan in Ontario. Estate planning involves creating a plan to indicate how your property and healthcare will be managed in the event of a disability. If you own any assets at all — a home, a car, savings or retirement accounts, for example — or you have loved ones who depend on you, you need an estate plan. Learn about the benefits of a will, estate planning, and how to settle an estate so that you could transfer your assets after death. We'll walk you through how to create and formalize your estate plan with our 4-step estate planning checklist. Learn about the benefits of a will, estate planning, and how to settle an estate so that you could transfer your assets after death. Here are five estate planning steps everyone should have on their checklist when working on their estate plan. The many components include a will, tax planning, life insurance, funeral preparation, charitable giving, beneficiary designation, and arrangements for minors. An estate plan is a collection of legal documents like wills, powers of attorney, and trusts. These documents outline what happens to your assets after you die. In this article, we will explore the key aspects of estate planning, its significance, and the steps to create an estate plan in Ontario.

Creative Planning offers a comprehensive suite of estate planning services designed to complement your financial plan. Online wills and estate planning Help provide your loved ones with a financial safety net if you pass away. Ensure your assets are passed on properly while. Estate experts discuss five reasons to update your will and estate plan to account for business and life changes and to ensure your wishes stay aligned. Estate Planning: 10 Things You Should Know · 1. An estate plan covers decisions in life and death · 2. You need more than a will · 3. Have a plan, or the. Estate planning checklist. Review the tips below. Decide if each one is suitable for you or not, if you plan to do it, or if you need to look into it more. Estate planning has several components including creating a will, designating your beneficiaries, outlining your funeral wishes, planning charitable gifts, and. Estate planning Estate planning is the process of anticipating and arranging for the management and disposal of a person's estate during the person's life in. 5 Key Estate Planning Tools. Wills, trusts, powers of attorney, living wills and life insurance can work together to help you plan your estate. The AEP designation recognizes true expertise and excellence in estate planning. Enroll in our AEP program today to begin your journey. If you own any assets at all — a home, a car, savings or retirement accounts, for example — or you have loved ones who depend on you, you need an estate plan. 5 steps to create an estate plan. See ways to help you save on taxes and protect your assets and privacy. Estate planning is putting your affairs in order so that your loved ones are taken care of if you die or are incapacitated. Although estate planning can be a complex task, a well-informed plan can make a big difference in what is left for your loved ones. Estate planning is the process of mapping out how your property and assets will be distributed in the event of your death. Using these 10 estate planning tips can give you peace of mind that your family will be cared for should you die or become disabled. Explore estate planning for freelancers and gig workers. Learn about tax planning, creating a will, asset management, planning for incapacity, and more. Step 1: Sign a will | Step 2: Name beneficiaries | Step 3: Dodge estate taxes | Step 4: Leave a letter | Step 5: Draw up a durable power of attorney. This comprehensive estate planning section provides information about common estate planning topics and tools. Your estate consists of everything you own: your home, personal property, car, land, stocks and bonds, life insurance and any other property in which you. Estate Planning - Wills and Trusts Important: The California Attorney General does not give legal advice to individuals. If you are trying to decide how to.